Introducing BookWatcher: The Ultimate Solution for A/B-Book Reporting

Say Hello to Effortless P&L Reporting For A/B Book Trading!

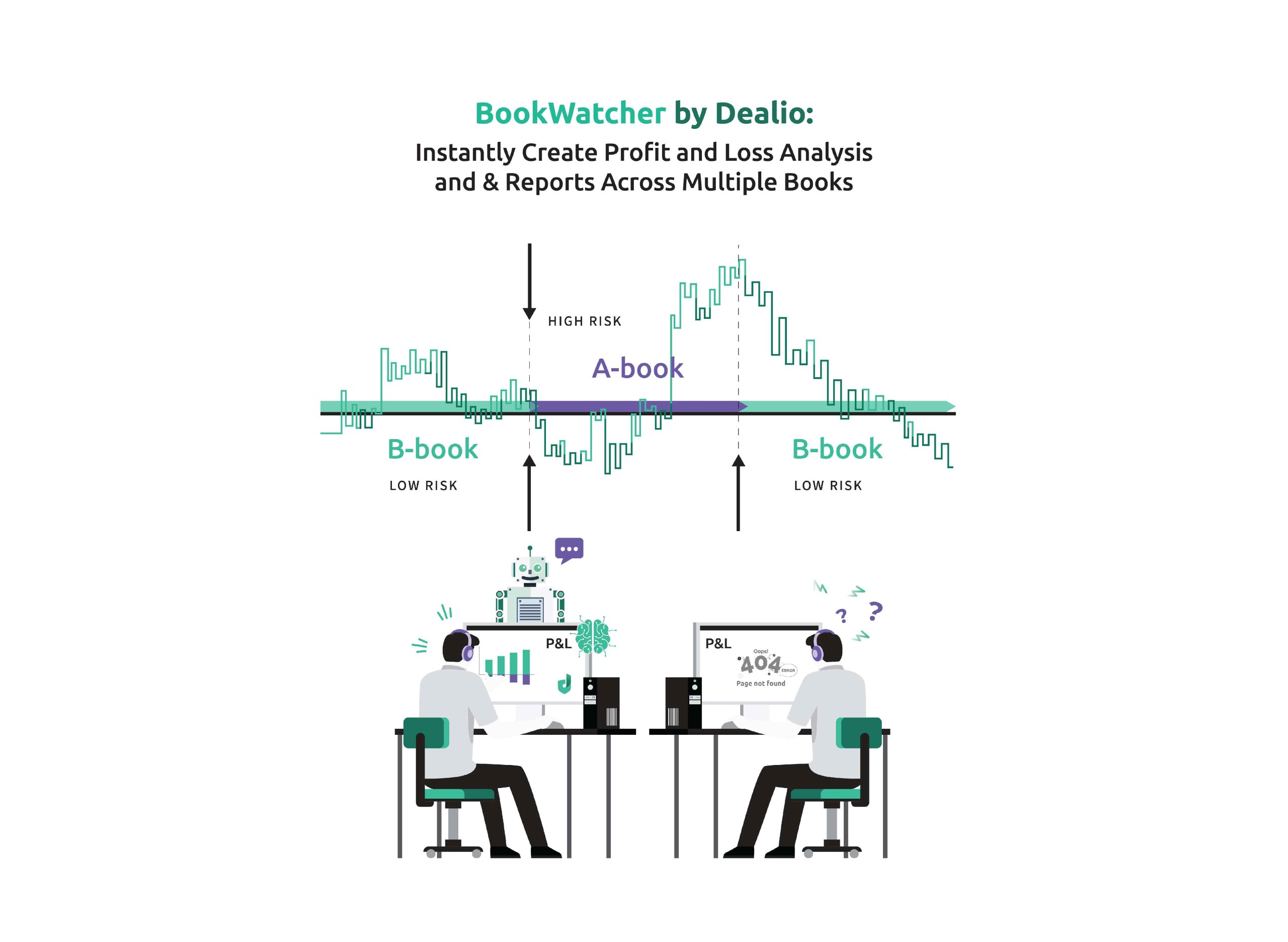

Our continuous efforts towards simplifying and automating risk management for FinTech industry paid off with the release of our latest tool, the BookWatcher! This innovative feature incorporated into the DealioX platform is a much-needed solution aimed at addressing a big void many retail brokers feel. That is the effective book allocation of the trade known as A/B book switch, and cross-books reporting on PnL (profit and loss). Let’s dive into Dealio’s A/B–book solution in more detail.

Why Book Allocation Is Important?

Book allocation is a critical component of risk management and profitability for every retail broker. By strategically allocating accounts and trades to different books, brokerage companies can mitigate exposure risk and optimize profitability. High-risk accounts are typically hedged or partially hedged based on the broker's risk appetite, while low-risk accounts may have their risk retained within the broker's book. The successful implementation of book allocation decisions hinges on the broker's effectiveness in evaluating past decisions, allowing them to develop and refine their strategies according to their needs. However, this is barely achievable when the information about the past switching is missing or is inaccurate.

Where Is The Gap?

The frequent switching of books often creates a significant gap in data management. To accurately measure account profitability, detailed information such as account group, equity, PnL, open trades, and book placement at the time of switching is essential. This data is currently unavailable on most trading platforms, hindering in-depth analysis and leading to various operational challenges. Without precise records, brokers face difficulties in generating accurate reports, reconciling volumes, and making informed decisions. PnL discrepancies and inconsistencies arise due to missing or inaccurate information about account status during book changes. This can particularly problematic when open positions are involved. This lack of comprehensive data significantly impacts the overall efficiency and reliability of the trading process.

Monitoring of Accounts

Lack of essential details due to poor record keeping can negatively impact the ability to monitor accounts objectively during the full course of their existence. Continuous monitoring demands knowing all the details about an account to make informed decisions. The historical data is often impossible to be separated with common methods to the periods when the account was on different books.

BookWatcher – A/B Book Solution For Brokers

The BookWatcher captures the trading account’s state any time the group of an account is changed. As such, the user detailed logs for book strategy evaluation, PnL calculations, reconciliation, and enhanced user statements. This new feature can capture effortlessly an all-inclusive record that will be available for future reference and reporting. On top of that, it can be used in combination with Dealio’s existing tools to generate live alerts tailored to the user’s requirements.

Some of the most vital information that each record contains is:

- Account Details

- Timestamp of the change

- Balance

- Equity

- Closed PnL

- Open Trades

Having the above information makes it easy to track any group of changes made on any account. By tracking book changes on a per-account basis with ease, the BookWatcher ensures the completeness and accuracy of data. This empowers brokers to optimize their book allocation strategies and make informed decisions for optimal performance.

To learn more about BookWatcher and how it can help your broker simply schedule a free demo with one of our risk experts.